The eCommerce market is growing day by day at a large scale in India. The days are gone in which sending money online is a difficult task for many people. Receiving money online was tremendously a challenging task. Now, with the remarkable transformation in the marketing and technology in India, people tend to receive or send money with ease.

This has become possible with the help of the best payment gateways. The introduction of various online gateways made the transactions easy. If you are planning to start your brand or business, then choosing the right payment gateway is an important task.

Payment gateways are embedded with various features that let people transfer money from one account to another with ease. Payment gateways are the mode of transfers that connect the merchant’s account to his/her bank account.

When you make payment with the help of payment gateway apps, then you need to fill your bank information, credit/debit card info, and much more so that payment gets easily transferred. These payment gateways usually verify the various details of bank accounts and make your payment transfer process much easier.

You can easily transfer the amount from one account to another within a fraction of some seconds. Therefore, these payment gateways have become an essential part of human life. With so many payment gateways available in the market, you need to choose the one that has embedded with several features like secure payment, languages available, and much more.

Choosing the right payment gateway for transactions is a difficult task. But, here we make the process much easier. We have listed the top 10 payment gateways that will make your transaction secure. But, before getting into the list, we have listed some benefits of using payment gateways.

The benefit of using payment gateways for transactions

Most of the eCommerce sites that have large traffic on it require the use of payment gateway on a daily basis. These gateways are used to transact money from buyers’ accounts to the merchant account. Therefore they are very beneficial for those having eCommerce business. Not only is that, but payment gateways also beneficial for transferring the instant amount to another account. There are several benefits of using payment gateways for online transactions. They are listed below:

- Payment gateways lead to secure transactions.

- It will help in increasing the customer’s base.

- Your money will be transferred within a fraction of seconds.

- Money transferring will be convenient and reliable.

- It can easily be added to eCommerce websites or stores.

- Helps in faster payment processing.

- Integrates with any website with ease.

- Payment gateways also prevent fraud and provide fraud management.

- It also provides recurring billing.

So, these are some of the benefits of using payment gateways for the online transaction. Now let us get deep into the list of top 10 payment gateways in India one can use for making online payments.

Top 10 payment gateways in India one can use for online payments

1. Instamojo

This is one of the popular payment gateway used by the number of people who are running their eCommerce business. It has the capability to support approx 22000 businesses in India. It is considered to be one of the largest payment gateways of our country India. You can register on this payment gateway free of cost within some seconds.

This payment gateway provides a secure payment of money from one account to another. This payment gateway is compliant with PCI-DSS so that the transaction is safe with this gateway. This simplified payment solution will help you to pay money with credit cards, debit cards, and net banking.

Other key features of this app include no annual maintenance cost required, simple APIs, and much more. We recommend you to use this best payment gateway for your eCommerce business.

2. CCAvenue

One of the top payment gateway used in India is CCAvenue that was established in the year 2001. This is one of the oldest payment gateways that let you transfer your money with ease. It is considered to be one of the best payment gateways with around 200 payment options available.

It also allows customers to use their cards like debit or credit cards to make the payment. This great payment gateway is available in over 18+ languages so that you do not find any difficulty while paying your bills. You can set up your payment account with zero percent initial setup fees.

It has also been embedded with various features like mobile app integration that includes Android, iOS as well as Windows mobile. You can serve your customers with the help of this payment gateway.

3. PayUMoney

PayUMoney is one of India’s leading payment gateways that is empowering over 45000+ businesses. It provides payment solutions to a large number of businesses with its cutting edge and award-winning technology. Their secure and safe ecosystem for payment makes it a top choice for a large number of people.

It offers a wide range of payment options that will help you to transact your money from one account to another. You can associate debit cards, credit cards as well as UPI payment mode with this great payment gateway. The payment through PayUMoney is made by a secure and 128 bit SSL encryption mode. You can also set up two-factor authentication while using this payment gateway. Go and use this gateway on your Android and iOS mobiles and transfer money within seconds.

4. Razorpay

Razorpay has also excelled in the list of top 10 payment gateways in India. This payment gateway will allow you to grow your business with its powerful mode of transaction. You can easily accept payment from various customers and automate payouts to vendors with the use of Razorpay.

With the help of this amazing payment gateway, you can easily collect recurring payments, share invoices with your clients, and make a secure payment. It has included almost 100 and more payment modes like debit or credit card payment, net banking, UPI, and wallets.

You can set up your free account on Razorpay and enjoy transferring money with ease. This API driven platform will let you make an instant payment subject to bank approval. So, what are you waiting for? Use Razorpay to pay your clients and grow your eCommerce business.

5. Citrus Pay

Citrus pay is another most advanced payment gateway used by a large number of businesses. It offers a wide range of payment options that will include American Express, MasterCard, and Visa Card, etc. It has been developed with high levels of security so that you do not experience any fraud activity while having getting paid pr transferring money. Enjoy the seamless transfer of your amount with Citrus Pay gateway. You can also scan and pay at various payment points with the help of this app.

6. EBS online payment service

This is one of the most used payment apps by business owners. This payment service provides a high level of advanced security while transferring money from one account to another. You can create an account for transactions on EBS for free, but you need to provide Rs.1200 as a maintenance charge.

This amazing app supports almost 11 currencies that you can use for payment. You can do mobile integration of this app from your website by sending mobile app integration request. You will get excellent payment choices with the use of the EBS payment gateway.

7. DirecPay

DirecPay is another best payment gateway in India. This integrated online payment gateway provides the best payment solutions to merchants. This payment gateway gives you a suite of different payment options. It has been integrated by debit or credit cards and provides you a fast, reliable, and secure passage of money from one account to another.

This amazing payment gateway also provides you payment processing with multi-currency support. This encrypted gateway needs one-day activation. You can easily use this payment gateway with its simple to use interface.

8. Cashfree payment gateway

Cashfree is the most trustworthy gateway to sent payments online. This merchant friendly gateway is easy to use and charges the lowest transaction fee for transactions. You can use any card, net banking, UPI, and wallets to transfer amount from one account to another.

There is no annual maintenance fee for maintaining your Cashfree account. You can easily customize the color and logo of the payment page as per your requirements. Make use of a Cashfree online payment gateway for all your transactions.

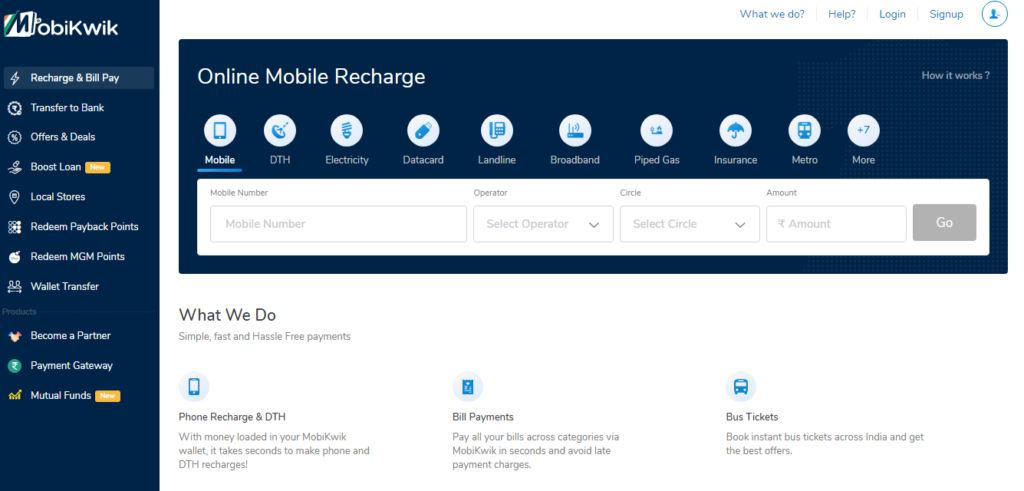

9. Mobikwik

Mobikwik is one of the famous payment gateways in India. With the use of Mobikwik, you can easily accept payments through Netbanking, Wallets, UPI, and all Indian and international master cards, Visa cards, and much more. This gateway does not provide any multi-currency support, but the transactions will be secure as the payments are PCI-DSS compliant. You can also do easy web integrations with the use of this payment gateway.

10. PayPal

This global payment network is popular among 200+ countries. It has widely being used among Indians. You can easily collect international payments from clients using this amazing payment gateway. There is no initial fee to set up your PayPal account, and you can also do easy web as well as mobile integration of this payment gateway.

The payments are secure, and you can receive payment from foreign clients with banking regulations. Use this amazing payment gateway to receive money from your international clients.

Conclusion

So, these are some top 10 best payment gateways that are widely used by Indian business persons. These payment gateways are easy to use, and you can easily do transactions from one account to another.

Most of these payment gateways do not require any maintenance fees, so you can easily create accounts on these gateways without a hitch. The payment gateways have made the money transfer process much easier. Now you can easily make online payments without worrying about security.